the ultimate application of a smart card depends on its various functions, such as payment processing, identification, network computing, protection, profit distribution and so on. applications will process the data that is read by the smart card reader and transmitted to the central computer at the other end of the system. these central computers for smart card systems include banks payment servers, traffic control centres, mobile phone centres, credit card servers, government and other server providers. Smart card applications and issuers include many companies or organisations such as banks, governments, agencies, security enforcement agencies, electronics manufacturers, and service providers who develop and exploit smart card technology for their own benefit.

in fact, billions of smart cards are already in use around the world. the value of smart card transactions worldwide reached UNITS 1.6 billion in 1998, up 23% from UNITS 1.3 billion in 1993. Western Europe accounts for 70 per cent of transactions using smart cards, South America and Asia each account for 10 per cent, while North Americas share is less than 5 per cent. However, the majority of smart cards currently in use are still currency cards, which have very limited processing capacity. there are, of course, around one million processor cards in use today. in European and Asian countries, where coin-operated telephones are being phased out, calling cards are already quite common. these prepaid cards have increased the revenues of payphone companies and allowed more complex transactions to be carried out with public telephones. While the popularity of telephone cards has contributed significantly to widespread consumer awareness of smart cards, it is expected that the fastest growing smart card of the 21st century will be the processor card.

Smart card technology and users

A smart card is a card fitted with a synthetic loop chip. the combination of a traditional plastic card and a processor allows the smart card to store, recall and process large amounts of information whether or not it is online. the data storage capacity of a smart card is hundreds of times greater than that of an ordinary magnetic stripe card. the information and operations stored on the smart card IC chip can be transmitted via a miniature electronic component connected to the terminal. there is also a remote-controlled smart card that transmits information via its own wireless coil in contact with a receiving antenna.

Depending on the chip loaded, a smart card can be either a stored value card or a processor card. the key aspect of a smart card is that it has an IC chip, but this chip may only be a memory. Memory cards can store thousands of times more information than magnetic stripe cards, but are currently restricted to general applications such as telephone IC cards.

the processor smart card has an extremely sophisticated microprocessor that can provide a variety of functions as a processing device, such as advanced security mechanisms, local data processing, complex arithmetic and other interactive processes. Most memory cards that combine security, recognition and identification with information value are processor cards. Only processor cards can be adapted to the flexibility and versatility of the network economy.

All cards containing an IC chip can be called smart cards. Although a PC card is also a smart card, it is unique in that it is used exclusively for personal activities and has all the characteristics of a smart card, but is only used as a peripheral device, such as a modem or a game floppy. these PC cards cannot usually be called smart cards because they are simply peripheral devices without any personalisation. in this sense, a smart card is a processor card that allows people to connect digitally with each other to conduct business or other activities.

Smart card technology consists of four important components.

1. card manufacturing

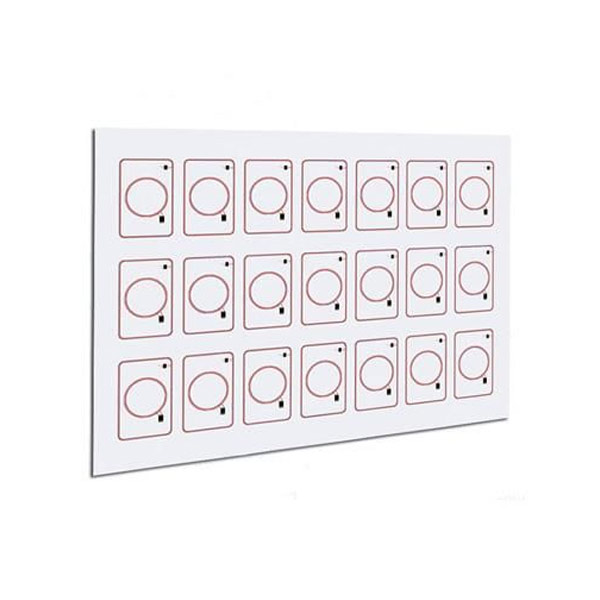

A smart card starts with a controller, which is supplied by a semiconductor manufacturer. This synthetic closed-circuit chip is inserted into a hole in a micro-assembly to which it is connected, and a number of terminals between the chip and the electronic micro-assembly are then connected to each other. Finally, the micro-assembly containing the chip is fixed to the plastic card and a smart card is created.

2. card terminals and card readers

Smart card data can be read by conventional card readers or wireless terminals. A new, floppy disk-like device allows the floppy drive of a PC to read smart card data as well. POS and ATM card reader manufacturers are also starting to produce smart card readers. A worldwide federation has begun to emerge in this area.

3. interface between card and terminal

there are a number of connectors in the electronic micro-assembly attached to the smart card, and through these connectors, the exchange of information between the chip on the IC card and the card reader can be achieved. Some international standards, such as ISO7810, specify that different connectors handle different types of data, but a program must be designed to run on a network processor to manage the exchange of information. the availability of an interoperable, multi-platform application interface (API) is critical to the versatility of smart cards. there are a number of publicly available API standards, such as those provided by Java Smart Cards, and the Java cardAPI is unique in that it provides a set of tools that can be used in a wide range of applications, from networked computers, internet TVs, smart phones and other consumer devices.

Advantages of smart cards

Smart cards offer greater security, convenience and economic benefits than traditional data transmission devices. in addition, smart card-based systems are highly adaptable to suit the needs of different people. Smart cards can be used as payment, application, network work and many other functional devices. the versatility of smart cards makes them an ideal user interface in the network economy.

1. Security

Smart cards include encryption and authentication technologies to meet the security needs of issuers and users. With encryption, information and data can be transmitted securely over wired or wireless networks. For example, using biometric authentication based on individual rational traits, smart cards can be used to allocate government benefit payments to reduce fraud and misuse. Health cards can provide doctors with easy access to information and ready access to patients medical records and insurance information. Personalised network connectivity cards allow secure and easy management of multiple different networks without the cost of dedicated controls.

2. Convenience

Smart cards can also combine the functions of identification, ATMs, photocopiers, payphones, health cards and more in one place. For example, a health card can directly access information about the patient that exists on the smart card, thus reducing documentation costs. there are also many smart cards that combine authentication functions with specific purposes, such as public interest cards used by governments and campus cards that can be used in universities to register students and purchase food.

3. Economic benefits

Smart cards reduce the cost of government profit payment programs because they do not use paper and therefore do not have the cost of paper handling. This saves on labour costs and time spent on manual work. the convenient smart card payment system reduces the maintenance costs of vending machines, petrol pumps and pay phones. At the same time, statistics show an increase in financial revenue of around 30%.

4. Userisation

A smart card contains personal networks, internet connections, payments and other applications. Using a smart card, people can establish a personal network connection anywhere in the world via a call centre or information desk. A web server authenticates the user based on the information read on the smart card, providing a customised web page, e-mail connection and other authorised services. the personal settings established for electronic devices, including computers, are not stored on the device itself but on the smart card. For example, telephone numbers are stored on smart cards rather than on telephones. Once smart cards become commonplace, a single smart card in the hands of a user is equivalent to the entire network and his personal computer.

5. Other advantages

Cash is still a very important means of payment in todays society. therefore, there is a need to find a safer, more convenient and more economical alternative to the cash function. Currently around 80% of all payments are made in cash. Smart cards have the following advantages over cheques and credit cards

(1) Reduced operational costs.

(2) increased ease of use.

(3) Reduced infrastructure support costs, such as maintenance costs for banking systems and telephone networks.

(4) Multiple functions of credit cards, cards and currency memory cards are combined on one platform, enabling multiple functions to be performed by one card.

(5) Reduced cost of collection and payment.

IV. Future development of smart cards

the payment system function of the smart card combines multiple parts of the smart card application, as there is more than one way to pay for smart card services. However, for smart cards to be widely used as an ideal payment method. Two controversial issues must first be addressed: legal protection against accidental loss or fraud, and microprocessing.