In the global amusement and attractions industry, cashless technology has become more than a convenience — it’s now a strategic pillar of park management and guest experience. As digital transformation reshapes how people pay, theme parks and water parks are under pressure to deliver faster, safer, and more personalized experiences. Carrying cash or even traditional cards feels outdated when guests can simply tap, scan, or wear their Payment method.

In this article, we’ll explore the five best cashless Payment options currently shaping the amusement and hospitality sectors — focusing on how each system works, its operational advantages, and the scenarios in which it performs best.

Why Theme Parks and Water Parks Are Moving Toward Cashless Systems

For operators, adopting a cashless Payment system is about far more than convenience. It’s a comprehensive operational upgrade that enhances safety, drives revenue, and creates a seamless guest journey.

First, speed and efficiency are immediate benefits. During peak seasons, parks handle thousands of small transactions at food kiosks, locker rentals, and souvenir shops. Traditional Payment methods cause long queues, which negatively impact guest satisfaction. Cashless systems, especially RFID-based ones, reduce each transaction to just a second or two — dramatically improving throughput and guest flow.

Second, safety and hygiene have become critical since the pandemic. Reducing cash handling means minimizing touchpoints, which is particularly valuable in water parks where wet currency and electronic cards are impractical.

Third, data analytics is now a major motivator. Modern RFID or NFC systems generate real-time data on spending patterns, dwell times, and guest preferences. Park operators can analyze this data to optimize retail layouts, promote targeted offers, and forecast inventory demand with precision.

Finally, increased spending is a proven outcome. When Payments are frictionless — especially through prepaid RFID or mobile wallet systems — guests tend to make more spontaneous purchases. Studies from major amusement groups show that parks adopting rfid wristbands see 20–30% higher average spending per guest compared to cash-only environments.

rfid wristbands represent the gold standard of cashless Payment technology in water and theme parks. These bands integrate high-frequency (HF) or ultra-high-frequency (UHF) RFID chips, which enable secure, contactless communication with readers placed across the park — from food courts and gift shops to ride entrances and locker systems.

When guests arrive, they receive a wristband preloaded with funds or linked directly to a credit card. Each band has a unique ID that connects to the guest’s digital profile, allowing for multi-functionality: access control, locker management, ride ticketing, and instant Payments.

For operators, the benefits are extensive:

Speed and waterproof reliability: rfid wristbands work seamlessly in water-based environments where phones and cards fail.

Increased spend and loyalty: The psychological barrier of physical Payment is removed, encouraging additional purchases.

Operational control: Real-time tracking enables insights into guest movement and spending patterns.

Enhanced security: Lost wristbands can be easily deactivated in the system, protecting guest funds.

From Disney’s MagicBand to integrated systems in major water resorts across Asia and Europe, RFID wearables have become the backbone of smart park ecosystems. Their ability to integrate Payment, access, and personalization makes them the most robust and scalable solution available today.

2. Mobile Wallets (Apple Pay, Google Pay, Samsung Pay)

Mobile wallet Payments have become an everyday norm for consumers worldwide, driven by the ubiquity of NFC-enabled smartphones and smartwatches. In the context of theme parks, these digital wallets bring simplicity and speed to every transaction — eliminating the need for physical cards or cash.

Using Near Field Communication (NFC) technology, mobile wallets create encrypted, tokenized transactions that are both secure and instantaneous. Guests can pay at any NFC-enabled POS terminal, often by simply holding their phone or watch near the reader.

Operational advantages:

Instant onboarding: Visitors can use existing Payment apps, avoiding registration friction.

Secure transactions: Tokenization prevents the sharing of card numbers, reducing fraud risk.

Integration with loyalty programs: Many parks now connect digital wallets to reward systems, automatically applying discounts or points.

However, mobile wallets have practical limitations in water-based attractions, where guests may not carry phones. For dry zones, hotels, or restaurants within a park, though, mobile wallets remain a highly efficient and globally familiar option.

QR code–based systems offer a cost-effective alternative for parks that want to implement cashless functionality without investing heavily in RFID infrastructure. Guests simply scan a unique QR code at each vendor’s checkout using their smartphone camera or a park app.

The Payment links to their preferred method — either a stored wallet balance, debit card, or mobile wallet account. This system is particularly attractive for seasonal or smaller parks where large-scale RFID integration may not yet be viable.

Advantages include:

Low implementation cost: No need for expensive RFID readers or specialized bands.

Easy deployment: Cloud-based QR Payment platforms can go live in days.

Marketing flexibility: Codes can link to promotions, food menus, or loyalty systems.

Still, QR Payments rely on smartphone accessibility and reliable internet connectivity — both of which can be challenging in certain park zones. Moreover, in wet environments, scanning a QR code may not be practical. Thus, QR systems work best in dry retail areas, cafes, and quick-service counters as a supplemental solution.

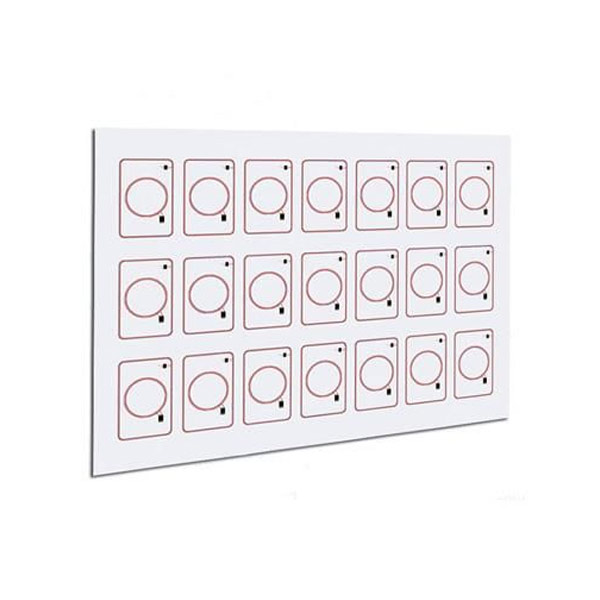

Prepaid smart cards combine the simplicity of traditional gift cards with the intelligence of RFID or NFC technology. Each card stores digital currency, allowing guests to pay across different park zones without carrying cash or linking personal bank details.

For families or group visitors, prepaid cards offer shared account management — parents can pre-load a balance and allocate spending limits to their children’s cards. This approach is both secure and convenient, as it prevents overspending and provides a straightforward refund process at the end of a visit.

Benefits for operators include:

Offline reliability: Payments can still process even with temporary network interruptions.

Inclusion: Suitable for guests without smartphones or digital wallets.

Brand reinforcement: Custom-branded smart cards double as marketing tools and souvenirs.

Prepaid cards are particularly effective in parks that mix dry and wet attractions. When combined with RFID gates or POS systems, they form a hybrid cashless ecosystem that’s both scalable and user-friendly.

5. Biometric and Wearable Payment Solutions

The latest innovation wave in cashless transactions is biometric Payment technology, where guests authenticate Payments through fingerprint, facial recognition, or even palm vein scanning. Some parks are experimenting with NFC-enabled wearables like smart rings, pendants, or lanyards — combining luxury design with advanced functionality.

Biometric systems eliminate the need for any physical token. Once enrolled, guests can access rides, lockers, or restaurants simply by verifying their identity biometrically. The process is powered by secure databases and encryption protocols compliant with global data protection standards.

Key advantages:

Hands-free convenience: Ideal for water environments where carrying devices is inconvenient.

Enhanced security: Biometric identifiers are unique and hard to duplicate.

Premium experience: Creates a futuristic brand image and higher-value perception.

However, such systems require robust data privacy governance and high initial investment in biometric readers and integration. They’re currently most suitable for premium resorts and advanced smart parks looking to differentiate their guest experience.

How to Choose the Right Cashless System for Your Park

Selecting the ideal cashless Payment model requires balancing guest convenience, operational capability, and financial feasibility. Each park has unique environmental and demographic conditions that influence system performance.

Key evaluation criteria include:

Environmental Compatibility: Water parks demand waterproof RFID wearables, while theme parks with dry zones may integrate QR or NFC systems.

Integration Capabilities: Seamless connectivity with POS, ticketing, CRM, and ERP systems ensures consistent data flow and reduced reconciliation errors.

Scalability: Systems should support seasonal scaling and multi-location operations without major infrastructure changes.

Guest Demographics: Younger audiences expect mobile-first experiences; families often prefer prepaid or wristband-based options.

Data Security & Compliance: Solutions must comply with PCI DSS, GDPR, or local data protection standards.

From an RFID industry perspective, the ideal strategy is often hybrid deployment — combining rfid wristbands for high-traffic wet zones with mobile or QR solutions for retail and hospitality areas. This approach optimizes cost while maintaining a unified guest experience.

Future Trends in Cashless Payments for the Amusement Industry

The next evolution of cashless technology is moving beyond Payment — toward fully connected guest ecosystems. Several key trends are shaping this future:

IoT and Smart Infrastructure: Connected lockers, vending machines, and gates will communicate directly with central systems, enabling predictive maintenance and automatic service updates.

AI-Driven Personalization: By analyzing guest behavior data, AI can offer tailored promotions or suggest less crowded attractions, improving both experience and revenue.

Blockchain Security: Blockchain-based Payment ledgers enhance transparency and prevent fraudulent transactions in multi-vendor environments.

Sustainable Materials: The RFID industry is increasingly adopting eco-friendly, biodegradable wristband materials, aligning with parks’ green initiatives.

As the industry matures, the cashless model will evolve from being an operational convenience into a strategic differentiator, defining how guests interact with every element of a park — from ticket entry to the final souvenir purchase.

Conclusion

The shift toward cashless Payments in theme and water parks is no longer optional — it’s a competitive necessity. rfid wristbands, mobile wallets, QR codes, smart cards, and biometric systems each offer unique benefits depending on park type, budget, and visitor profile.

Implementing a robust, integrated system enhances guest satisfaction, streamlines park management, and increases per-capita spending. For park operators aiming to deliver a next-generation guest experience, investing in a smart, secure, and hybrid cashless Payment ecosystem is the most reliable path forward.